About Setupfiling.in

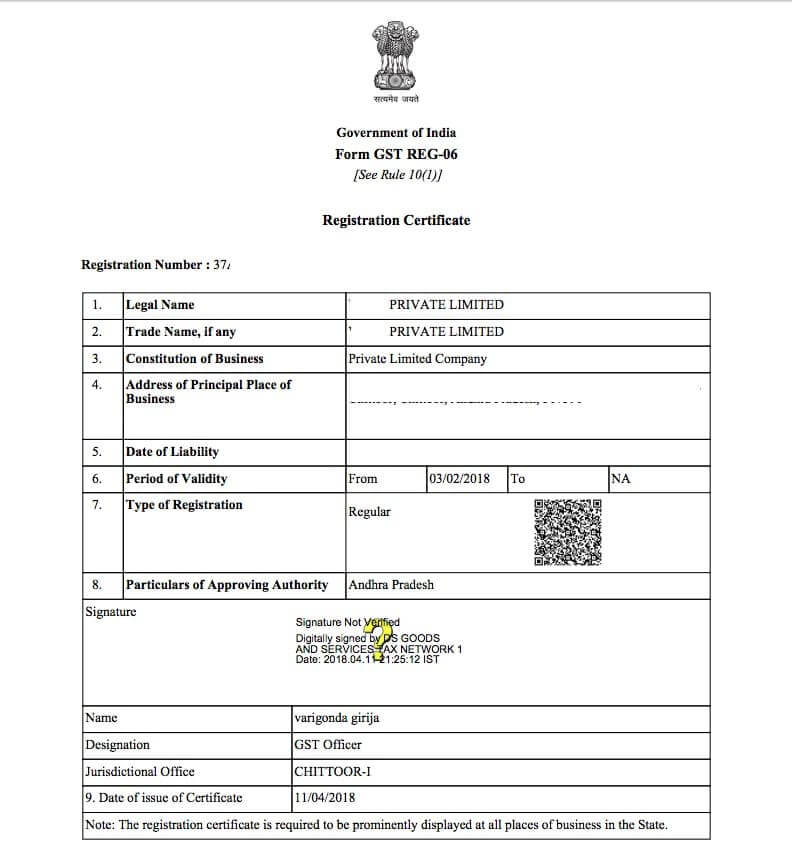

Setupfiling.in is an online leading platform for company registration, GST registration, trademark registration, income tax return filing, income tax audit, ROC return filing, and other tax and compliance management services. They are a one-stop-shop for all your business needs.