GST Registration in Uttar Pradesh

Are you a business owner in Uttar Pradesh? If so, you need to register for GST! GST is a new tax system that will simplify and unify the way you pay taxes. It will also make it easier for you to do business with other businesses across India. Don’t delay, register for GST today! Contact us to apply for gst registration in Uttar Pradesh

GST Registration Fee

₹1499

₹

999/-

-

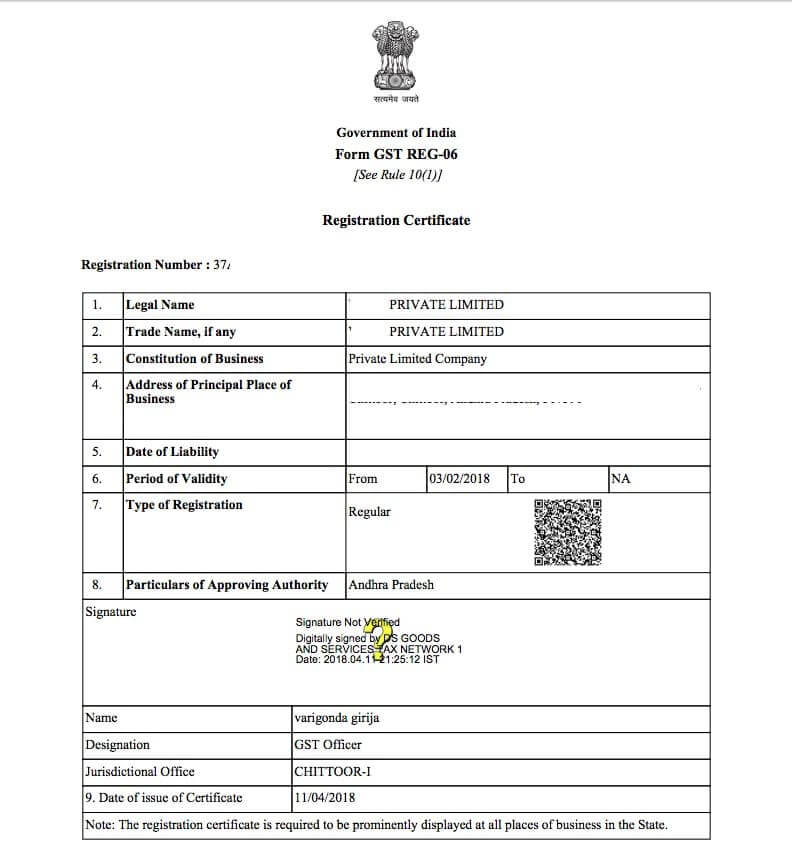

GST Registration Certificate

-

User ID and Password of GST portal