GST Registration in Delhi

Are you a business owner in Delhi looking to register for GST? You’ve come to the right place! In this comprehensive guide, we will walk you through the process of GST registration in Delhi step by step. From eligibility criteria to registration procedure, we’ve got you covered. Let’s dive in!

GST Registration Fee

₹1499

₹

999/-

-

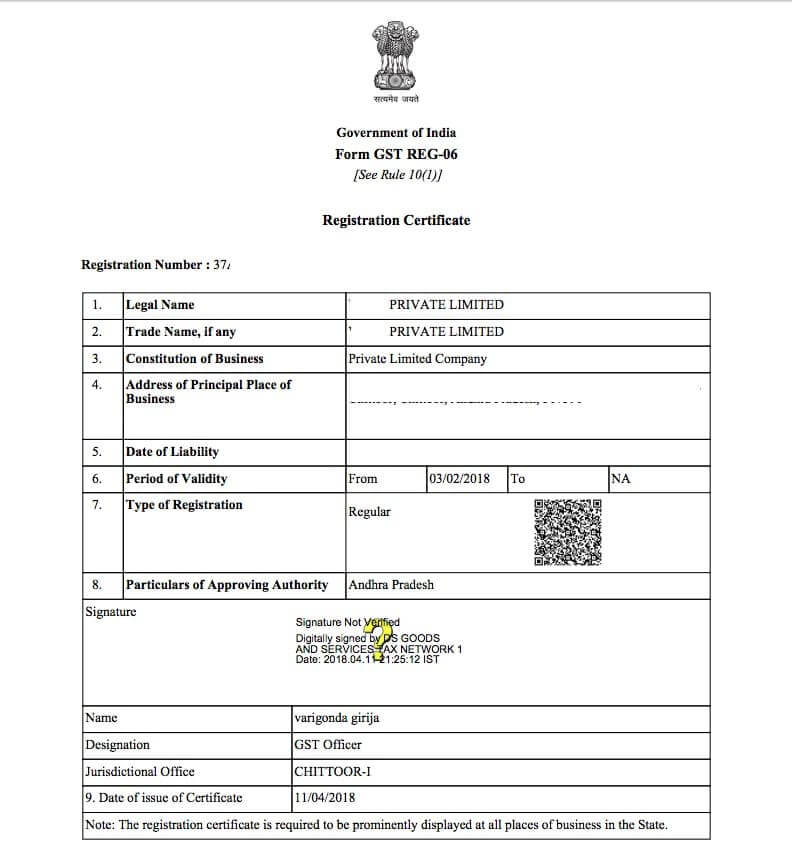

GST Registration Certificate

-

User ID and Password of GST portal