GST Registration Service

End-to-End Assistance* for GST registration.

Required Documents for GST Registration

- Pan card

- Adhaar card

- Photograph

- Business address proof

- Renet agreement (If Rented)

- Property tax receipt (If Owned)

- Electricity bill

- Consent Letter (If any)

GST Registration Fees

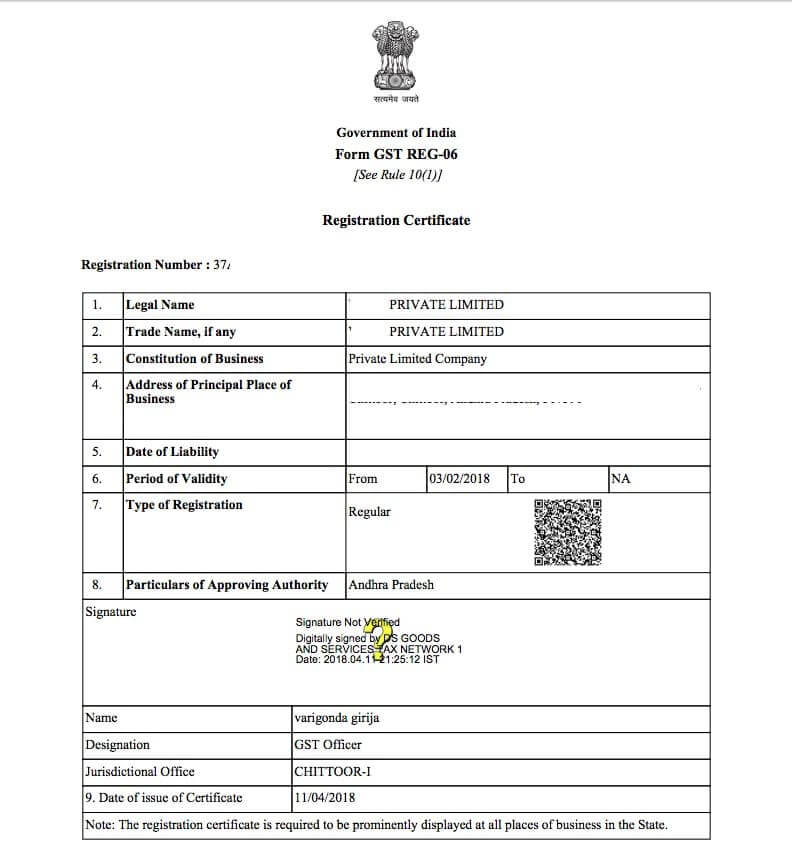

- GST Registration Certificate

- GST Portal User id and password

- All India Service

- Easy Onlie Process

- 24*7 Hours Customer Support

GST Registration Services: Overview

Goods and Services Tax (GST) registration is a crucial process for businesses in India that are engaged in the supply of goods and services. It is mandatory for businesses whose annual turnover exceeds the prescribed threshold limit. GST is a comprehensive indirect tax that has replaced various other taxes like VAT, service tax, and central excise.

GST Registration Turnover Limit

GST registration can be obtained voluntarily by any person or entity irrespective of turnover. GST registration becomes mandatory if a person or entity sells goods or services beyond a certain turnover.

- Service Providers: Any person or entity who provides service of more than Rs.20 lakhs in aggregate turnover in a year is required to obtain GST registration. In special category states, the GST turnover limit for service providers has been fixed at Rs.10 lakhs.

- Goods Suppliers: As per notification No.10/2019 any person who is engaged in the exclusive supply of goods whose aggregate turnover crosses Rs.40 lakhs in a year is required to obtain GST registration. To be eligible for the Rs.40 lakhs turnover limit, the supplier must satisfy the following conditions:

- Should not be providing any services.

- The supplier should not be engaged in making intra-state (supplying goods within the same state) supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripur and Uttarakhand.

Should not be involved in the supply of ice cream, pan masala or tobacco.

If the above conditions are not met, the supplier of goods would be required to obtain GST registration when the turnover crosses Rs.20 lakhs and Rs.10 lakhs in special category states.

Special Category States:

Under GST, the following are listed as special category states – Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand.

Aggregate Turnover:

Aggregate turnover = (Taxable supplies + Exempt Supplies + Exports + Inter-State Supplies) – (Taxes + Value of Inward Supplies + Value of Supplies Taxable under Reverse Charge + Value of Non-Taxable Supplies).

Aggregate turnover is calculated based on the PAN. Hence, even if one person has multiple places of business, it must be summed to arrive at the aggregate turnover.

Types of GST Registration

1. Regular GST Registration (Normal Taxpayer):

- This is the most common type of GST registration.

- Businesses with an annual turnover exceeding the prescribed threshold limit (Rs. 20 lakhs or Rs. 10 lakhs for special category states) are required to register under GST.

- These businesses collect GST from their customers and can also claim input tax credit on their purchases.

2. Composition Scheme Registration:

- Small businesses with an annual turnover up to a certain limit (Rs. 1.5 crore for goods and Rs. 75 lakhs for services) can opt for the Composition Scheme.

- Under this scheme, businesses pay GST at a fixed rate on their turnover

- They are not eligible to claim input tax credit.

What is GSTIN?

GSTIN or Goods and Services Tax Identification Number (GSTIN) is provided to entities having GST registration number. GSTIN is 15 characters in length. The allocation of GSTIN is based on PAN and State of the applicant. In a GST registration number, the first two digits represent the State Code. The following next 10 digits represent the PAN of the applicant.

Register for GST through Setupfiling

You can obtain your GST registration through setupfiling in 7 -15 working days. However you will get temporory ARN Number instantly. First you need to order online by Clicking Here >>

Once We will received order we will allocate one GST Experts for documentation purpose. The GST expert will also collect and verify the documents required to obtain GST registration. Once the payment is initiated we start with the GST registration process and we upload all your application into the GST Portal.

You obtain the GST registration within 7-15 working days. Everything is completely online you don’t need to be physically present at the office for the same. Once GST Registration will get approved, you will get GST Certificate and user id and password.

Voluntary GST Registration

Voluntary GST registration is an option for businesses in India to register for the Goods and Services Tax (GST) even if their annual turnover is below the mandatory threshold limit. This means that if your business’s turnover is less than the prescribed limit (which is Rs. 20 lakhs for service and Rs. 40 lakhs for goods) you can still choose to register for GST voluntarily.

Documents Required for GST Registration

Type of Entity | Required GST Registration Documents |

|---|---|

Sole proprietor / Individual |

|

LLP and Partnership Firms |

|

Company (Public and Private) (Indian and foreign) |

|

HUF |

|

Benefits of GST Registration

The following are some of the advantages of GST registration:

- Bank Loans: GST registration and GST return filing serve as proof of business activity and create track record for a business. Banks and NBFCs lend to businesses based on GST return data. Hence, GST registration can help you formalize your business and get credit.

- Supplier Onboarding: To become a supplier of reputed companies, GST registration is often times a must during the supplier onboarding process. Hence, GST registration can help you get more business.

- eCommerce: GST registration is a must to sell online and through various platforms like Amazon, Flipkart, Snapdeal, Zomato, Swiggy, etc., Hence, having a GST registration will allow you to sell online.

- Input Tax Credit: Entities having GST registration are eligible to collect GST from customer for the supply and offset the liability against GST taxes paid while purchasing various goods and services. Hence, GST registration can help you save on taxes and improve margins.

Get Your GST Registration with Ease!

Ensure your business complies with tax regulations and unlock new growth opportunities by registering for GST today.

Our experts at SetupFiling.in handle the entire process, from documentation to filing, saving you time and hassle.

FAQ's On GST Registration Service

GST number, also known as the Goods and Services Tax Identification Number (GSTIN), is a unique 15-digit alphanumeric identification number assigned to businesses and individuals registered under the Goods and Services Tax (GST) system in India. GST is a comprehensive indirect tax that replaced various other taxes like VAT, service tax, and central excise.

GST registration is mandatory for businesses whose aggregate turnover exceeds the prescribed threshold limit. Additionally, certain categories of businesses like those involved in interstate supply, TDS/TCS deductors, and casual taxable persons must also register. Voluntary registration is also an option.

Commonly required documents include PAN, Aadhaar card, address proof of the business

Now Day in most of the state registration process is taking time of 7-15 working day. however ARN number get generated instantly after filing application.