Get Your GST Certificate in 1 day

Get your GST Certificate today and make your business 100% legal! Quick, easy, and online registration. Build trust, claim tax benefits, and grow faster. Don’t wait—register now and download your GST Certificate hassle-free!

Get Free Expert Consultation

- All India Service

- Easy Onlie Process

- 24*7 Hours Customer Support

Choose The Best GST Registration Package For Your Business

Silver Package

48-hours Fast Track GST Application

- GST Form Filing in under 48 Hours

- GST Registration Certificate

- GST Portal User ID and Password

Gold Package

24-hours Fast Track GST Application + 6 Months GST Return Filing Service

- GST application filed within 24Hrs

- GST Certificate within 24hrs

- CA-led GST return filing for 6 months (up to 100 transactions)

Premium Package

24-Hrs Fast Track GST Application + 12 Months GST Return Filing

- GST Form Filing in Under 24 Hours

- GST Certificate within 24hrs

- CA-led GST return filing for 12 months (up to 100 transactions)

GST Certificate - Overview

Are you a business owner in India? If yes, then you must have heard about GST. GST stands for Goods and Services Tax. It is a single tax that is applied to the sale of goods and services in India. If your business earns more than a certain amount in a year, it is mandatory to register under GST and get a GST Registration Certificate.

But what exactly is a GST Certificate? Why do you need it? And how can you get it? This article will explain everything in simple language so you can understand and apply it to your business.

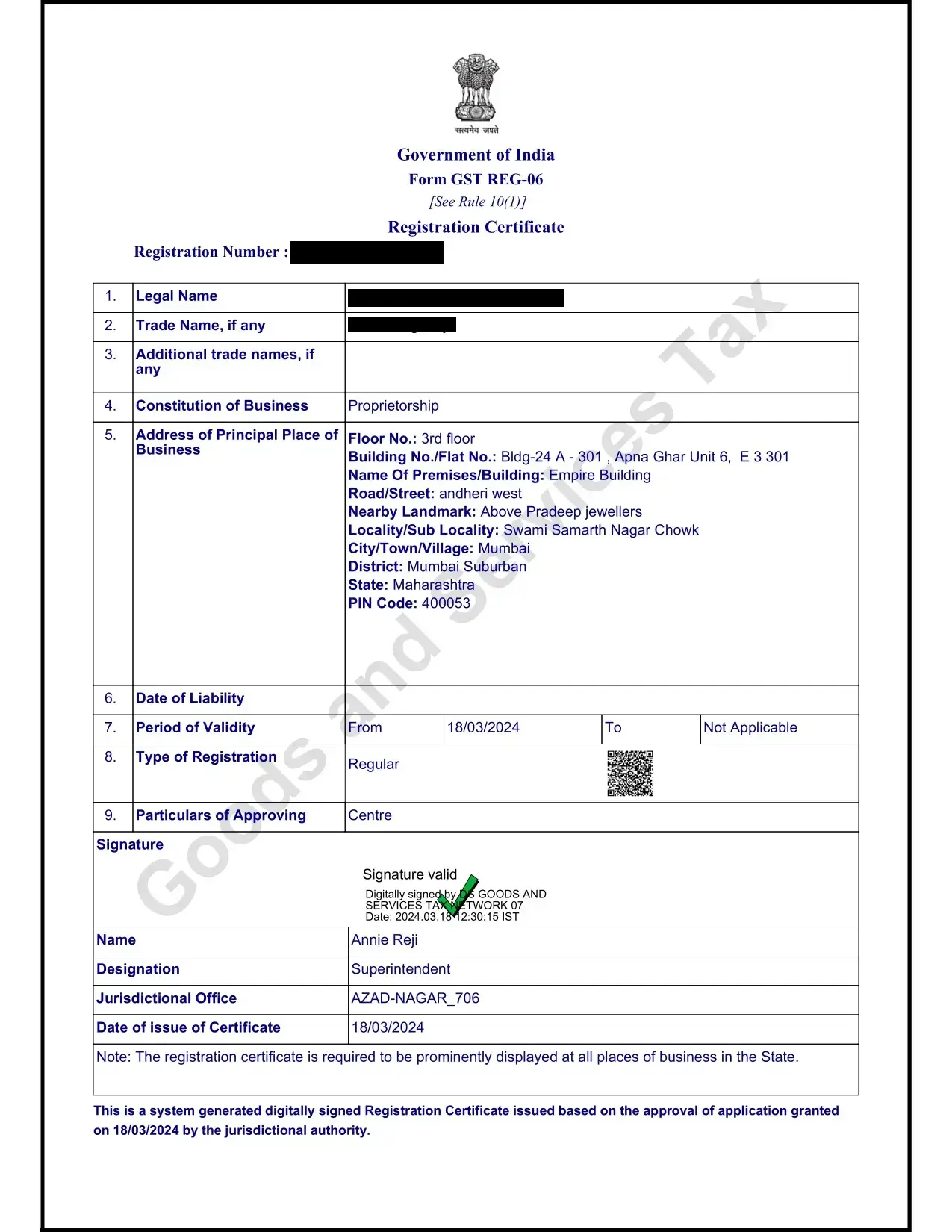

What is a GST Registration Certificate?

A GST Registration Certificate is an official document that proves your business is registered under GST law in India. It is issued by the Goods and Services Tax Department after you successfully register for GST.

This certificate contains important information such as:

- Your GSTIN (GST Identification Number)

- Legal name of your business

- Type of business (proprietorship, partnership, etc.)

- Address of your business

- Date of registration

- Type of registration (Regular, Composition Scheme, etc.)

This certificate is usually available in a PDF format that you can download from the GST portal. You don’t get a physical copy; everything is digital now.

Who Needs a GST Registration Certificate?

Not every business needs a GST Registration certificate. It is required if your business:

- Has an annual turnover of over ₹40 lakhs (₹20 lakhs for some states)

- Is involved in interstate trade

- Sells goods or services online

- Acts as an agent for another business

- Is under the reverse charge mechanism

- Wants to claim input tax credit

If any of these apply to your business, you must register for GST and get your GST Registration Certificate.

Documents Required for Online GST Registration

- Proprietor Pan card and adhaar card

- Proprietor Photograph

- Commercial Rent Agreement

- Electricity bill

- Proprietor Pan card and adhaar card

- Proprietor Photograph

- Electricity bill

- Property tax receipt - if any

How Long Does It Take to Get GST Number?

Usually, it takes 1 to 2 working days to get your GST number if all documents are in order. In some cases, a GST officer may ask for additional information, which can extend the time.

Why is a GST Number Important?

Getting a GST Registration Certificate has several benefits:

1. Legal Compliance

If your business qualifies for GST registration and you don’t register, you could face penalties and legal trouble. Having a GST Certificate keeps your business legal.

2. Builds Trust

Customers and partners prefer to work with registered businesses. Showing your GST Certificate builds trust and credibility.

3. Input Tax Credit

Once registered, you can claim input tax credit. This means you can reduce the tax you pay by the amount of GST you’ve already paid on purchases.

4. Expansion Made Easy

If you want to expand your business to other states or online platforms like Amazon or Flipkart, a GST Registration Certificate is a must.

How to Apply for a GST Certificate?

Applying for a GST Registration Certificate is simple and can be done online. Here is a step-by-step process:

Step 1: Visit the GST Portal

Go to the official GST portal

Step 2: Click on ‘Register Now’

On the home page, click on the ‘Register Now’ button under the ‘Taxpayers’ tab.

Step 3: Fill in Part A

You need to provide basic details like:

- PAN number

- Mobile number

- Email ID

- State

You will receive OTP verification codes on your phone and email.

Step 4: Fill in Part B

This part needs more detailed information such as:

- Name of the business

- Address of business

- Bank account details

- Business proof (like rental agreement or electricity bill)

- Identity proof (like Aadhaar, PAN)

You also need to upload scanned documents.

Step 5: Submit and Get ARN

After filling all the information, submit the application. You will receive an Application Reference Number (ARN).

Step 6: Get Your GSTIN and Certificate

After verification by the department, you will receive your GSTIN and can download your GSTIN Certificate from the GST portal.

How to Download GSTIN Certificate?

Once your registration is approved, you can download your GST Registration Certificate anytime. Here’s how:

- Log in to the GST portal

- Click on ‘Services’ → ‘User Services’ → ‘View/Download Certificates’

- Click on the ‘Download’ icon

Your GST certificate will be downloaded in PDF format.

Is the GST Certificate Permanent?

No, it is not permanent. Your GST Registration Certificate is valid as long as your GST registration is active. If your registration is cancelled or suspended, the certificate is no longer valid.

Also, if your business changes (like address or business type), you must update the details in the GST portal and a new certificate will be issued.

Penalties for Not Registering Under GST

If your business is required to register under GST and you don’t, you can face penalties like:

- A fine of ₹10,000 or 10% of the tax amount, whichever is higher

- Interest on unpaid taxes

- Business operations may be restricted

So it’s better to stay on the right side of the law and get your GST Certificate on time.

Get GST Certificate for your Business

100% Easy Online Process and Transparant Pricing

Order online and Whatsapp your Documents scan copy to us. Our team will apply for GST Application within 1-2hrs and will share you ARN Number.

GST Registration Certificate – FAQ

1. What is a GST Registration Certificate?

It is an official document issued by the GST authorities in India upon successful registration under the Goods and Services Tax (GST) regime. It serves as proof of registration and includes key details such as GSTIN, legal name, and business address.

2. Who needs a GST Registration Certificate?

You are required to register under GST if:

Your turnover exceeds the threshold limit (₹40 lakh for goods, ₹20 lakh/₹10 lakh for services depending on the state).

You are engaged in interstate supply of goods/services.

You are a casual taxable person, non-resident taxable person, or e-commerce operator.

You are liable to pay tax under reverse charge.

3. How can I apply for a GST Registration Certificate?

You can apply online via the GST portal: https://www.gst.gov.in. The process involves:

Submitting application Form GST REG-01.

Uploading necessary documents (PAN, address proof, identity proof, etc.).

Verifying through OTP or DSC.

4. How long does it take to get the GST Registration Certificate?

Generally, it takes 1–7 working days from the date of application submission, provided all documents are correct and no clarification is sought.

5. Is the GST Registration Certificate issued physically?

No, the GST certificate is not issued physically. It is available for download in digital format from the GST portal.

6. How can I download my GST Registration Certificate?

Log in to the GST portal > Services > User Services > View/Download Certificates.

7. What is GSTIN?

GSTIN stands for Goods and Services Tax Identification Number – a 15-digit unique code assigned to every GST-registered taxpayer.

8. Is there a validity period for the GST Registration Certificate?

For regular taxpayers: It is valid until it is surrendered or cancelled.

For casual/non-resident taxpayers: Valid for the period specified in the registration application or 90 days (whichever is earlier).

9. What if there are errors in my GST Registration Certificate?

You can file an amendment application on the GST portal to update any incorrect information.

10. Can I hold more than one GST Registration Certificate?

Yes, if you operate in more than one state or have multiple business verticals within a state, you can apply for separate GST registrations.

11. Is GST registration mandatory for freelancers or online sellers?

Yes, if your turnover crosses the threshold or you sell through an e-commerce platform, GST registration is mandatory.

12. What are the penalties for not registering under GST when required?

A person liable to register but fails to do so may be fined ₹10,000 or the amount of tax evaded, whichever is higher.

13. Can the GST Registration Certificate be cancelled?

Yes. It can be voluntarily cancelled by the taxpayer or by the GST officer in case of non-compliance or fraud.

14. What happens after cancellation of the GST Registration Certificate?

Once cancelled, the taxpayer is no longer liable to collect or pay GST and must cease using the GSTIN.

15. Can I reactivate a cancelled GST Registration Certificate?

No. You will have to apply for a fresh GST registration if your previous certificate has been cancelled.